In a welcome surprise for both homebuyers and sellers, mortgage rates have recently dropped to the lowest levels we’ve seen all year. This dip in rates is sparking new opportunities in an otherwise competitive and unpredictable housing market, leaving many wondering what it means for their real estate goals.

Here’s a breakdown of what this change could mean for you:

A Breath of Fresh Air for Buyers

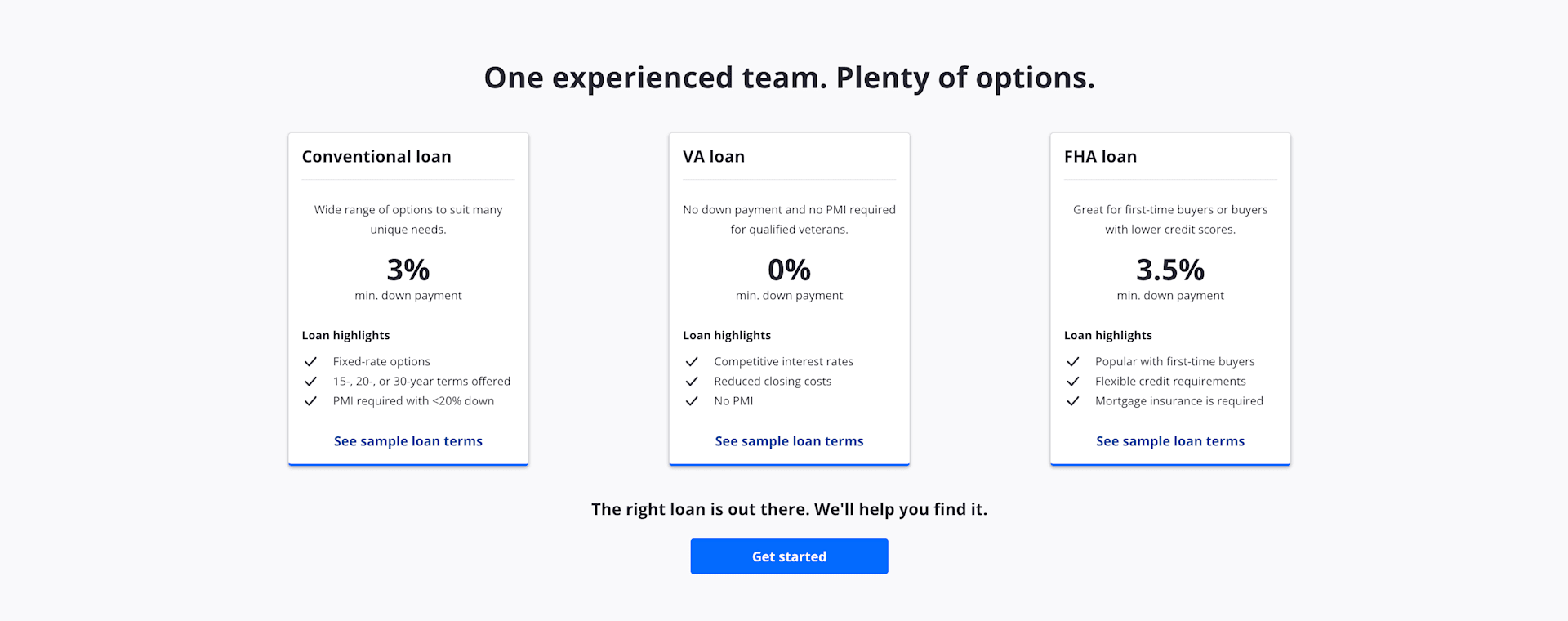

If you’ve been considering purchasing a home but have been holding off due to rising mortgage rates, now might be the perfect time to act. Lower mortgage rates can significantly reduce monthly payments, giving buyers more purchasing power or allowing them to secure their dream home for less. For first-time buyers or those on the fence, this rate drop opens the door to locking in a more affordable loan, potentially saving thousands of dollars over the life of a mortgage.

Example:

On a $500,000 home, even a slight drop in mortgage rates can translate into hundreds of dollars in monthly savings. A buyer who secures a 30-year fixed-rate mortgage at a lower interest rate now compared to earlier in the year may enjoy reduced financial strain, especially as home prices in desirable areas continue to hold strong.

For the week of September 9, 2024, the mortgage rates are as follows:

- 30-Year Fixed: 5.625% with an APR of 5.80%

- 30-Year Fixed Jumbo: 6.000% with an APR of 6.11%

To see how these rates affect various loan amounts, here’s a breakdown of monthly payments for loans ranging from $750,000 to $2,000,000 based on the current rates:

|

Loan Amount |

30-Year Fixed Payment |

30-Year Jumbo Payment |

|

$750,000 |

$4,317.42 |

$4,496.63 |

|

$1,000,000 |

$5,756.56 |

$5,995.51 |

|

$1,250,000 |

$7,195.71 |

$7,494.38 |

|

$1,500,000 |

$8,634.85 |

$8,993.26 |

|

$1,750,000 |

$10,074.00 |

$10,492.13 |

As shown above, taking advantage of these lower rates can lead to significant savings, whether you’re in the market for a standard loan or a jumbo loan.

Encouraging News for Sellers

Sellers benefit from this dip in rates as well. With lower borrowing costs, more buyers are likely to enter the market, which could lead to multiple offers on well-priced homes. If you’re thinking about selling, now could be a great time to take advantage of increased buyer demand, as the affordability factor encourages more people to explore the market.

Additionally, lower mortgage rates can help sellers who need to move up or downsize. Even if you’re selling your home, the reduced rates may make it easier to secure financing for your next property.

Refinancing Boom

Homeowners who aren’t necessarily in the market to buy or sell should also take note. With rates reaching their lowest point of the year, many existing homeowners are considering refinancing their mortgages. By refinancing at a lower rate, homeowners can reduce their monthly mortgage payments, shorten the term of their loan, or even tap into their home equity for renovation projects or other financial needs.

Timing is Key

While it’s always tough to predict how long rates will remain at these levels, waiting too long could mean missing out on these favorable conditions. Financial experts often encourage potential buyers and those considering refinancing to act quickly while the window is open.

What’s Next for the Market?

Although the current drop in mortgage rates is a positive sign, the broader real estate market is still experiencing challenges like low housing inventory and fluctuating prices. That said, as more buyers are drawn into the market due to improved affordability, we may see an increase in home sales and, potentially, more competitive bidding for prime properties.

Whether you’re buying, selling, or looking to refinance, it’s clear that now is the time to review your options. If you’re ready to take advantage of these low mortgage rates or need guidance on how this change impacts your real estate plans, don’t hesitate to reach out.

Are you thinking about making a move? Contact us today for personalized advice on how to navigate the current market conditions and secure the best rates for your home purchase or sale!